最高のコレクション yield formula for bonds 162881-Yield formula for bonds

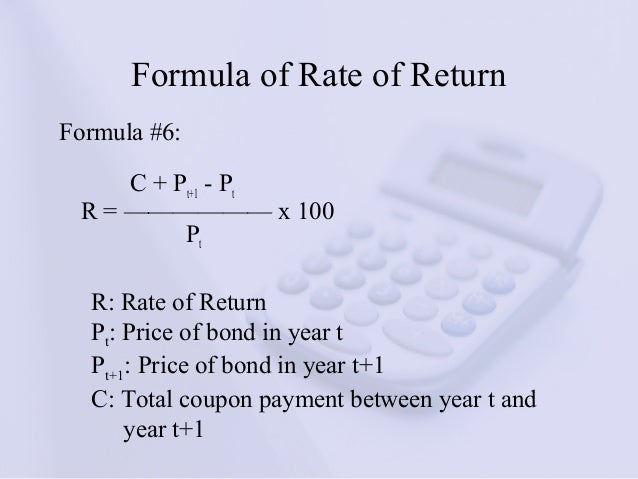

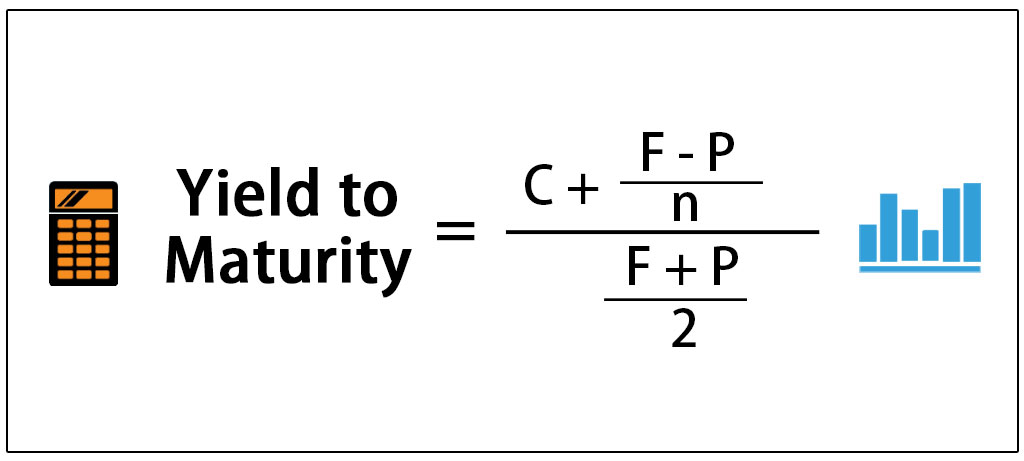

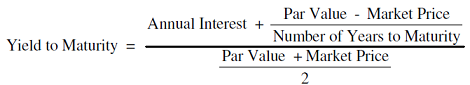

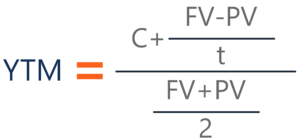

Yield is a general term that relates to the return on the capital you invest in a bond There are several definitions that are important to understand when talking about yield as it relates to bonds coupon yield, current yield, yieldtomaturity, yieldtocall and yieldtoworstYield to maturity (YTM) is similar to current yield, but YTM accounts for the present value of a bond's future coupon payments In order to calculate YTM, we need the bond's current price, the face or par value of the bond, the coupon value, and the number of years to maturityRemember the formula is Yield Dividend Growth = Total Returns So I took the yield at the beginning of 11 and added the 10year average annual dividend growth rate to get a total return estimate

Bond Yields Everything You Need To Know

Yield formula for bonds

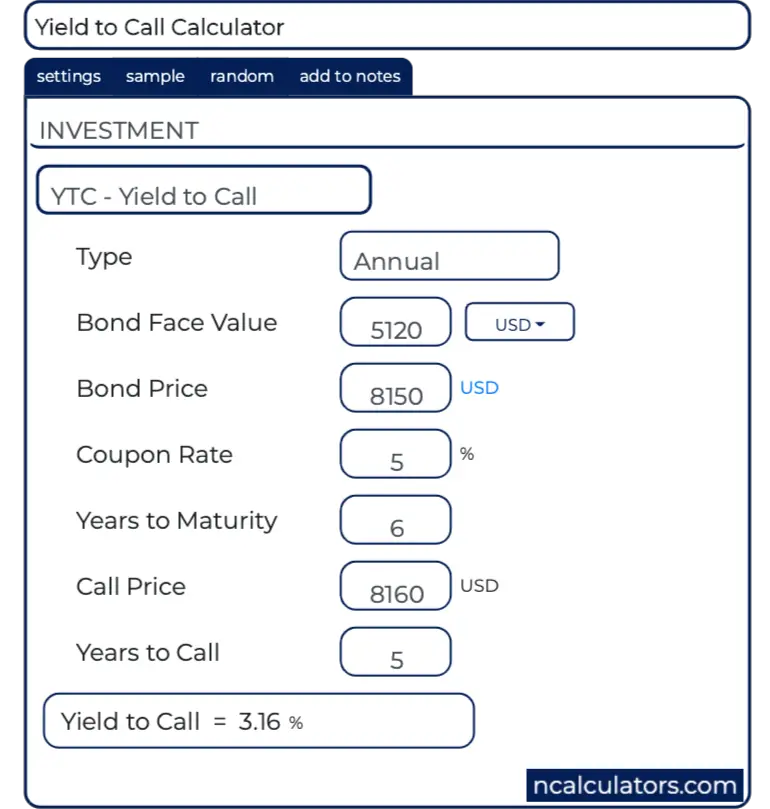

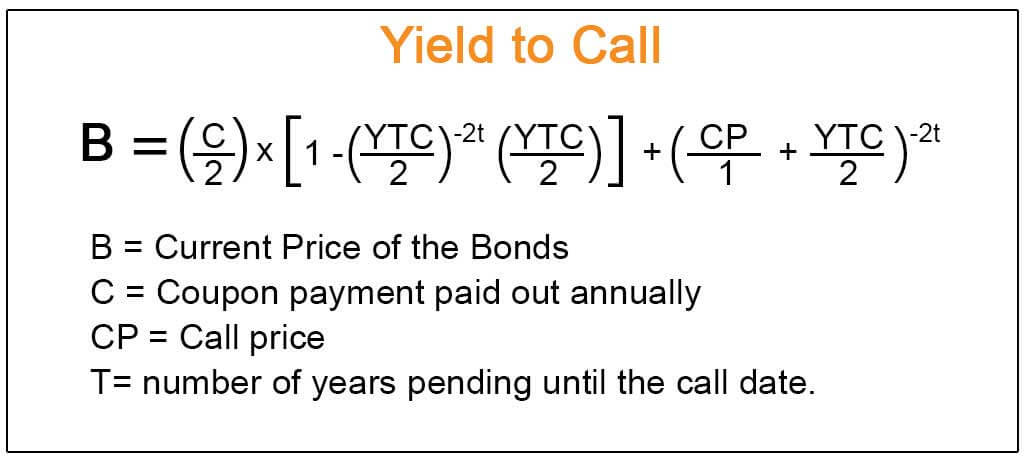

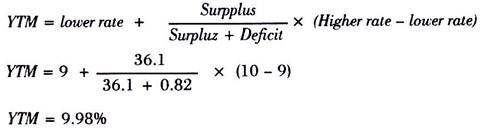

Yield formula for bonds-They are maturing on 15 November 19 The bonds have a market value per bond of 1125 as at 15 November 12 If the tax rate is 35%, find the before tax and aftertax cost of debt Before tax cost of debt equals the yield to maturity on the bond Yield to maturity is calculated using the IRR function on a mathematical calculator or MS ExcelBond Yield to Call Formula The calculation for Yield to Call is very similar to Yield to Maturity When making this calculation, we assume the bond will be called away at the first opportunity Additionally, the price to call bond is usually a bit more than the face value of the bond – we use the price to call for this formula instead of the

Calculating The Yield Of A Coupon Bond Using Excel Youtube

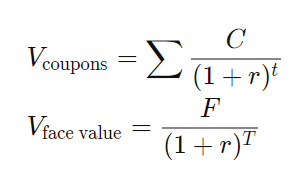

The resolution uses the Newton method, based on the formula used for the function PRICE The yield is changed until the estimated price given the yield is close to price Example Copy the example data in the following table, and paste it in cell A1 of a new Excel worksheet For formulas to show results, select them, press F2, and then press EnterBond Yield to Call Formula The calculation for Yield to Call is very similar to Yield to Maturity When making this calculation, we assume the bond will be called away at the first opportunity Additionally, the price to call bond is usually a bit more than the face value of the bond – we use the price to call for this formula instead of theA bond's yield is the return an investor realizes on a bond in percentage terms If a bond pays more than one cash flow (coupon), then there is no direct formula which can be used to calculate the bond's yield Instead, an iterative approach is used This is referred to as the yield to maturity (YTM)

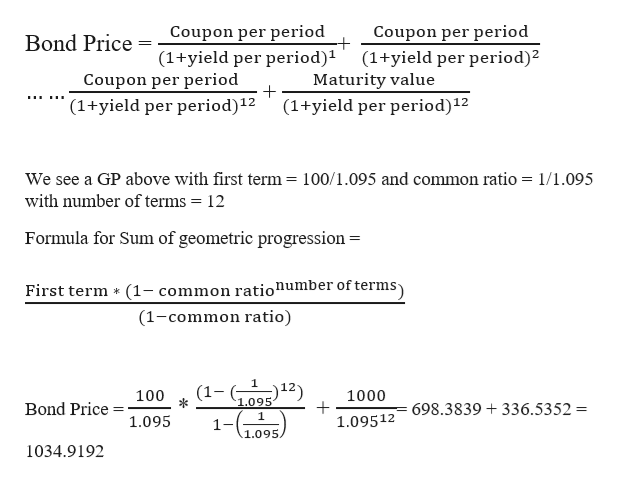

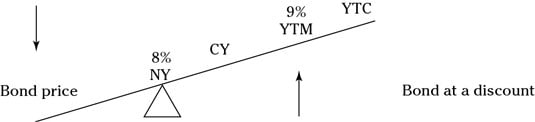

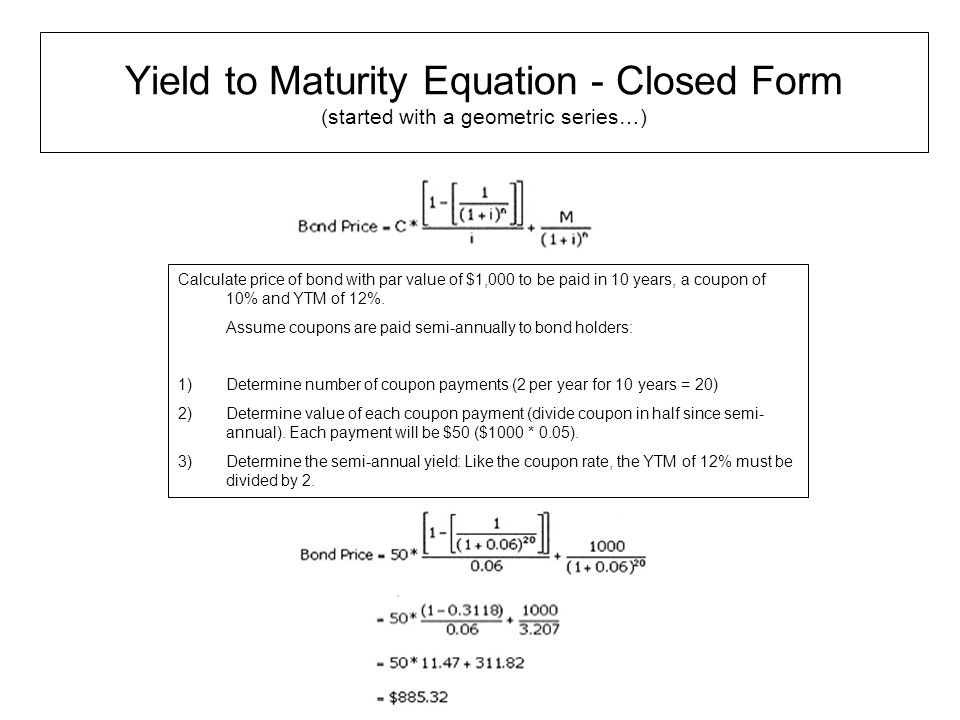

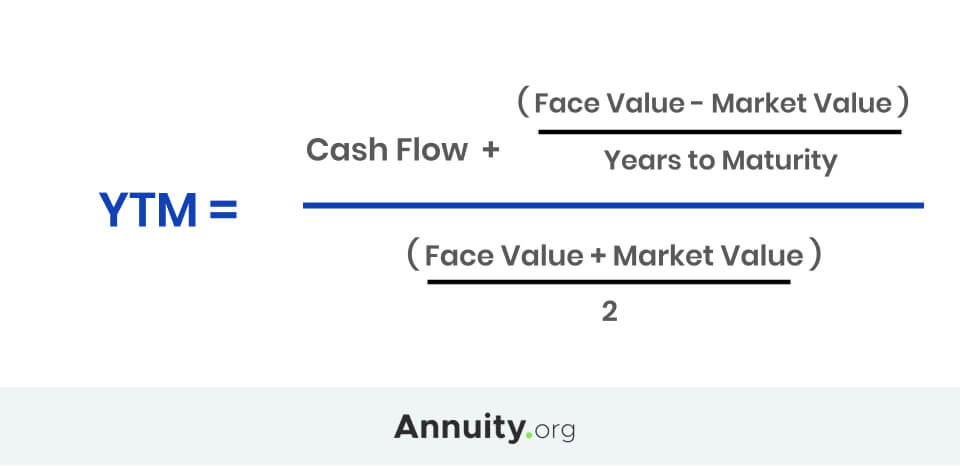

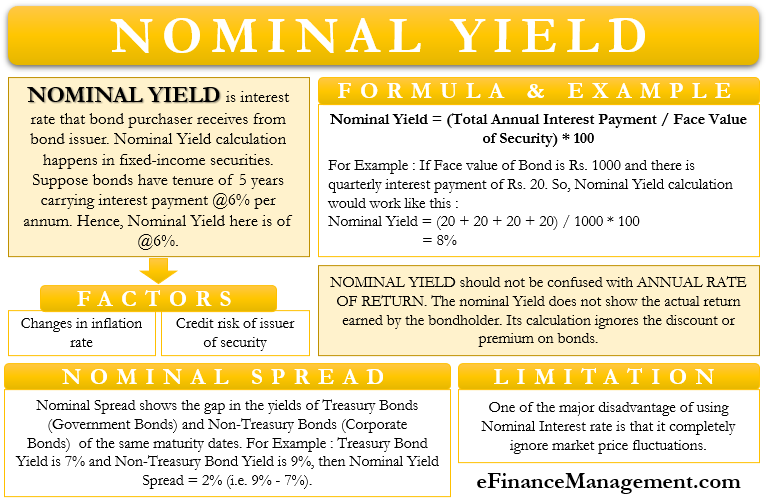

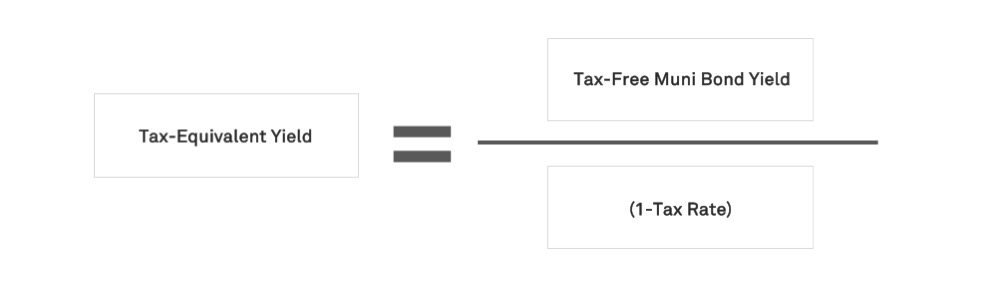

Nominal yield, or the coupon rate, is the stated interest rate of the bond This yield percentage is the percentage of par value —$5,000 for municipal bonds, and $1,000 for most other bonds — that is usually paid semiannually Thus, a bond with a $1,000 par value that pays 5% interest pays $50 dollars per year in 2 semiannual payments of $25A bond's yield is the discount rate that can be used to make the present value of all of the bond's cash flows equal to its price In other words, a bond's price is the sum of the present value ofExample of Yield to Maturity Formula The price of a bond is $9 with a face value of $1000 which is the face value of many bonds Assume that the annual coupons are $100, which is a 10% coupon rate, and that there are 10 years remaining until maturity This example using the approximate formula would be

The yield to maturity (YTM), book yield or redemption yield of a bond or other fixedinterest security, such as gilts, is the (theoretical) internal rate of return (IRR, overall interest rate) earned by an investor who buys the bond today at the market price, assuming that the bond is held until maturity, and that all coupon and principal payments are made on scheduleTherefore if the bond trades at the initial price of £5,000;The face value (also known as the par value) of the bond is essentially the price that will be paid to the investor on maturity of the bond This will usually be stated on the bond offering

An Introduction To Bonds Bond Valuation Bond Pricing

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-02-10d2adc981ea475eb2165a5ec13082ed.jpg)

Current Yield Vs Yield To Maturity

The yield to maturity is the total return than an investor would earn if he or she holds the bond until maturity Suppose an investor buys a 10year bond with a 6% coupon rate at $900 In this case, the total return for the investor would include a $60 coupon each for ten years, the par value of $1,000, and a capital gain of $100A $10,000 face value bond with a 6percent coupon pays $600 per yield in interest The current yield is the coupon rate or interest divided by the current price If the bond paying $600 per year costs $10,500, the current yield is 571 percent The yield to maturity amortizes a premium or discount over the remaining life of the bondThe face value (also known as the par value) of the bond is essentially the price that will be paid to the investor on maturity of the bond This will usually be stated on the bond offering

The Yield To Maturity And Bond Equivalent Yield Fidelity

Bonds Bond Prices Interest Rates And Holding Period Return Ppt Download

Bond Yield to Maturity Formula For this particular problem, interestingly, we start with an estimate before building the actual answer That's right the actual formula for internal rate of return requires us to converge onto a solution;An investor buys a bond in 1978, maturity in 1980, at Rs 900 It has a maturity value of 10 years and par value of Rs 1,000 It fetches Rs 90 every year Calculated yield This formula is an approximate method of calculating yield It takes into account the values a par and the purchase price of bonds and average itThe formula for calculating current yield of a zero coupon bond is as follows Current Yield for a Zero Coupon Bond = {Par Value / P^(1/T) – 1} x 100 For a zero coupon bond with a par value of $5,000, market price of $4,000 and 3 years left to maturity

Yield Function Formula Examples Calculate Yield In Excel

How To Use The Excel Yield Function Exceljet

Multiply your result by 100 to calculate the bond's yield as a percentage Concluding the example, multiply by 100 to get a 477 percent yield This means the bond's annual interestN – The number of coupon payments received in each year Practical Example Assume that you purchase a bond with a nominal coupon rate of 7%A rise in market price Now consider what happens when the market price of the bond rises eg because of strong investor

Berk Chapter 8 Valuing Bonds

What Is A Bond Yield Robinhood

The % yield on the bond is calculated by this formula Yield = interest on bond / market price of the bond x 100;If the bond is held to maturity, five years of interest would produce a 2425% total yield Or, if the bond was called after two or four years, you would have a total yield of 97% or 194%The bond's current yield is 67% ($1,0 annual interest / $18,000 x 100) But the bond's yield to maturity in this case is higher It considers that you can achieve compounding interest by reinvesting the $1,0 you receive each year It also considers that when the bond matures, you will receive $,000, which is $2,000 more than what you paid

Q Tbn And9gcrynatxciaobbvt Edbzcqmlgnhpv Acw5cqav2pwzm1fudi Ih Usqp Cau

Calculate The Ytm Of A Coupon Bond Youtube

The redemption yield spreads such capital gains or losses over the bond's lifespan, to give an annual return estimate for anyone buying today For very shortdated bonds, we can use a handy proxy called the simple yield Say we buy a bond for £95 with one year left to run and a 5% couponA bond's yield is the return an investor realizes on a bond in percentage terms If a bond pays more than one cash flow (coupon), then there is no direct formula which can be used to calculate the bond's yield Instead, an iterative approach is used This is referred to as the yield to maturity (YTM)The redemption yield spreads such capital gains or losses over the bond's lifespan, to give an annual return estimate for anyone buying today For very shortdated bonds, we can use a handy proxy called the simple yield Say we buy a bond for £95 with one year left to run and a 5% coupon

Calculating The Present Value Of A 9 Bond In A 10 Market Accountingcoach

Yield To Maturity Ytm Definition Formula And Example

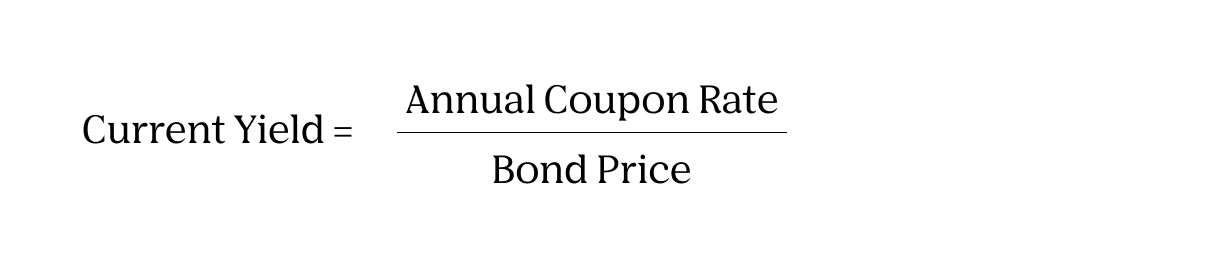

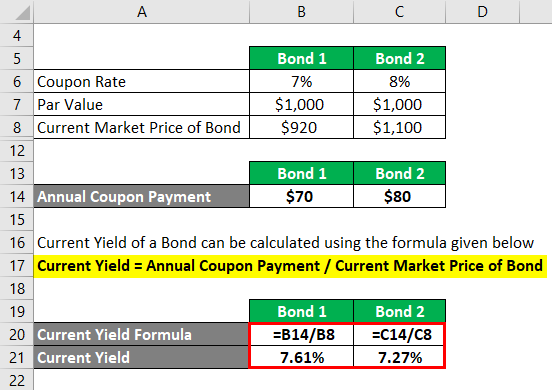

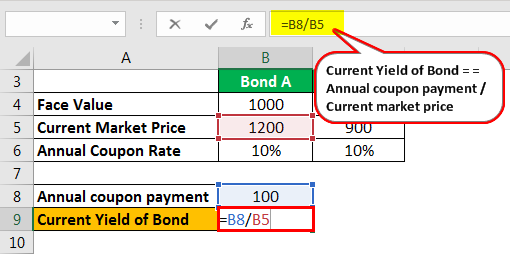

A bond's yield is the return an investor realizes on a bond in percentage terms If a bond pays more than one cash flow (coupon), then there is no direct formula which can be used to calculate the bond's yield Instead, an iterative approach is used This is referred to as the yield to maturity (YTM) Current Yield = Annual Coupon Payment Bond Price \text{Current Yield}=\frac{\text{Annual Coupon Payment}}{\text{Bond Price}} Current Yield = Bond Price Annual Coupon PaymentIt doesn't allow us to isolate a variable and solve Estimated Yield to Maturity Formula However, that

How To Calculate Yield To Maturity 9 Steps With Pictures

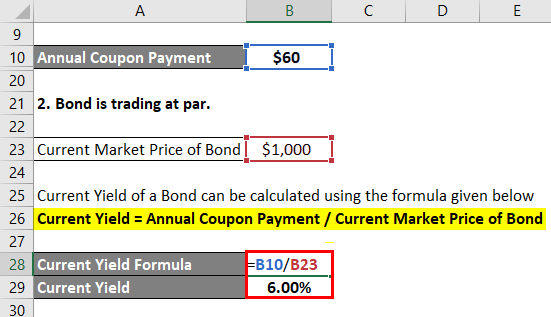

Current Yield Of A Bond Formula Calculate Current Yield With Examples

Then the yield = (£0 / £5,000) x 100% = 4% ;A simple formula for calculating a bond yield involves dividing the annual coupon by the price of the bond As an example, if the bond were priced at $ US Dollars (USD) with an annual coupon of $600 USD, the bond yield would be projected at six percentIf the bond is held to maturity, five years of interest would produce a 2425% total yield Or, if the bond was called after two or four years, you would have a total yield of 97% or 194%

Q Tbn And9gcrep5zibokjfj3edwx8is4wr7cvig3zhy26xqekz6n5kk4o0qfn Usqp Cau

Bond Yield Calculator

Bond Yield Formula = Annual Coupon Payment / Bond Price This formula basically depends upon annual coupon payment and bond price When bond price increases, yield decreases,Current yield = 70/700 = 10% If the bond sells for Rs 1400 the current yield will be 5% (2) Yield on bonds with maturity period A 5year bond of Rs 1,000 face value and 6% interest has a market value of Rs 840, find its yield A bond is an instrument of debt and resembles a promissory noteThe current yield of a bond is the annual payout of a bond divided by its current trading price That is, you sum up all coupon payments over one year and divide by what a bond is paying today Bond Current Yield vs Yield to Maturity

Yield To Maturity Definition How To Calculate Ytm Pros Cons

Bond Yield Calculator

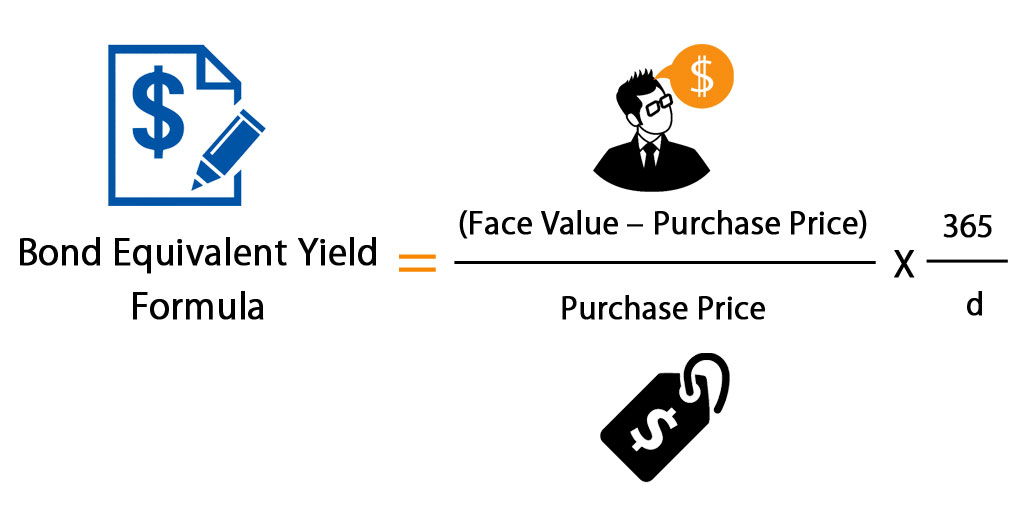

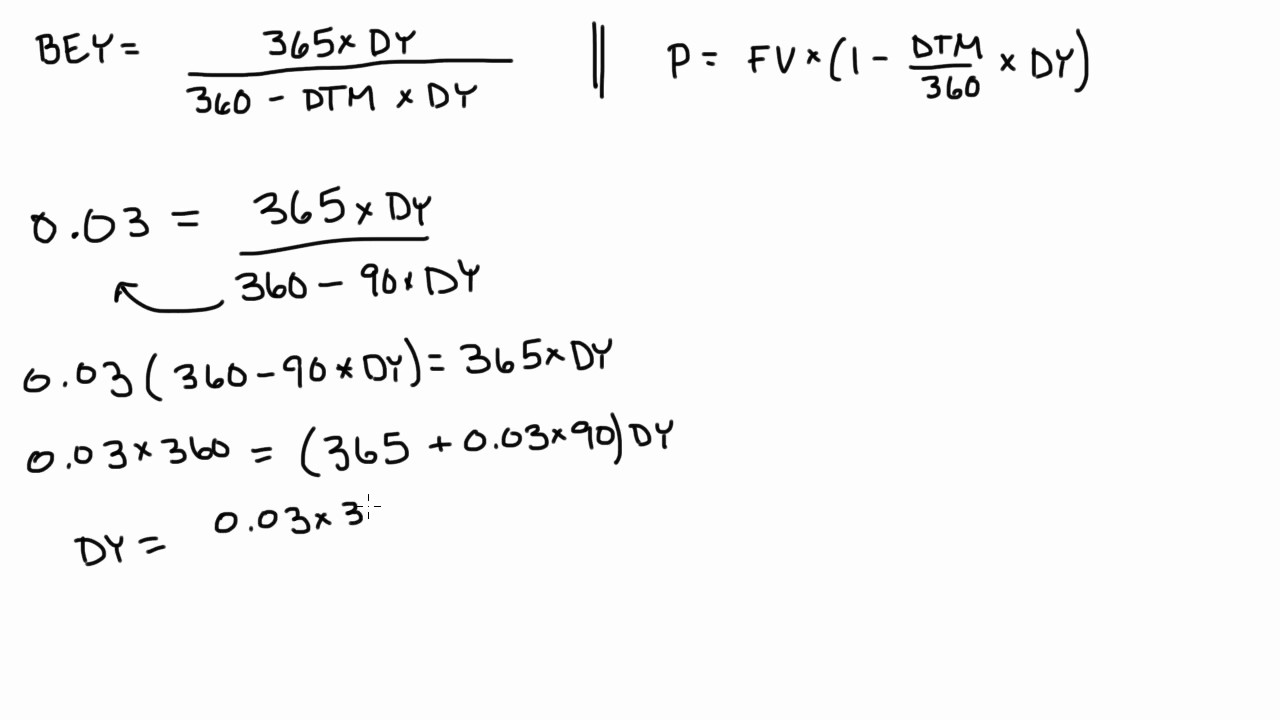

The yield for a bond is the total return you receive for investing in that bond The yield tells an investor how much they will receive for that investment Another aspect of analyzing bonds is the yield to maturity, which is quoted as the bond equivalent yieldThe formula is consistent with coupon bearing bonds Use a semiannual compounding period (N*2), the yield to maturity is an annual rate Yield to maturity inbetween coupon dates The concepts used for purchase and sales (settlement) dates inbetween coupon dates are similar to pricing bondsBond Equivalent Yield Formula Bond\ Equivalent\ Yield = \dfrac{Face\ Value Purchase\ Price}{Purchase\ Price} \times \dfrac{365}{d} d = days to maturity;

Current Yield Formula Calculator Examples With Excel Template

Calculating The Yield Of A Zero Coupon Bond Youtube

The current yield formula of a bond essentially calculates the yield on a bond based on the Market price, instead of face value The formula for calculating the current yield is as follows Current Yield of Bond = Annual coupon payment/ Current Market priceNominal Yield Nominal yield is a fixed percentage amount calculated for fixed income securities representing a stated yield for a bond It is calculated by dividing the Bond Pricing Bond Pricing Bond pricing is the science of calculating a bond's issue price based on the coupon, par value, yield and term to maturityYou will want a higher price for your bond so that yield to maturity from your bond will be 45% Let's calculate now your bond price with the same Excel PV function =PV (450%/4, 4*10, 1500, 100,000) = $112, So, you will be able to sell your bond at $112, with a premium of amount $12, Working File

Presentation1 Ppt Ass Ppt 222 Municipal Bond Yield Finance

Current Yield Formula Calculator Examples With Excel Template

Current yield is a bond's annual return based on its annual coupon payments and current price (as opposed to its original price or face) The formula for current yield is a bond's annual coupons divided by its current price Use of the Current Yield FormulaThe formula for Bond Yield can be calculated by using the following steps Step 1 Firstly, determine the bond's par value be received at maturity and then determine coupon payments to be Step 2 Next, determine the investment horizon of the bond, which is the number of years until its maturityStep 3 Finally, the formula for a current yield of the bond can be derived by dividing the expected annual coupon payment (step 1) by its current market price (step 2) and expressed in percentage as shown below Current Yield = Annual Coupon Payment / Current Market Price of Bond * 100% Relevance and Use of Current Yield of Bond Formula

Bond Pricing Formula How To Calculate Bond Price

How To Calculate Yield For A Callable Bond The Motley Fool

Calculate Yield of a 10 Year Bond Now let's calculate the yield of a 10year bond, which was issued on February 1, 09, and was purchased by the investor three months later Other details of the bond are mentioned in the above table The formula used to calculate the Yield is =YIELD(C4,C5,C6,C7,C8,C9,C10)The resolution uses the Newton method, based on the formula used for the function PRICE The yield is changed until the estimated price given the yield is close to price Example Copy the example data in the following table, and paste it in cell A1 of a new Excel worksheet For formulas to show results, select them, press F2, and then press EnterThe formula for determining approximate YTM would look like below The approximated YTM on the bond is 1853% Importance of Yield to Maturity The primary importance of yield to maturity is the fact that it enables investors to draw comparisons between different securities and the returns they can expect from each

What Is Yield To Maturity How To Calculate It Scripbox

Explained How To Calculate Yields On Your Bond Investments

In addition, there is a component of yield that comes from the difference between the bond's market price and the payment you would get if the bond were to be called Here is the YTC formulaFormula for Calculating the Effective Yield The formula for calculating the effective yield on a bond purchased Effective Yield = 1 (i/n) n – 1 Where i – The nominal interest rate on the bond;Again, Bond A came to the market at $1,000 with a coupon of 4%, and its initial yield to maturity is 4% The following year, the yield on Bond A has moved to 35% to match the move in prevailing interest rates, as reflected in the 35% yield on Bond B

What Is Yield And How Does It Differ From Coupon Rate

Yield To Maturity Ytm Calculator

The yield for a bond is the total return you receive for investing in that bond The yield tells an investor how much they will receive for that investment Another aspect of analyzing bonds is the yield to maturity, which is quoted as the bond equivalent yieldMultiply your result by 100 to calculate the bond's yield as a percentage Concluding the example, multiply by 100 to get a 477 percent yield This means the bond's annual interestBond Equivalent Yield Formula Bond\ Equivalent\ Yield = \dfrac{Face\ Value Purchase\ Price}{Purchase\ Price} \times \dfrac{365}{d} d = days to maturity;

Current Yield Formula Calculator Examples With Excel Template

Yield To Maturity Ytm Overview Formula And Importance

In addition, there is a component of yield that comes from the difference between the bond's market price and the payment you would get if the bond were to be called Here is the YTC formulaFormula for Calculating the Effective Yield The formula for calculating the effective yield on a bond purchased Effective Yield = 1 (i/n) n – 1 Where i – The nominal interest rate on the bond;N – The number of coupon payments received in each year Practical Example Assume that you purchase a bond with a nominal coupon rate of 7%

Bond Equivalent Yield Formula Step By Step Calculation With Examples

Current Yield Meaning Importance Formula And More

Bond Valuation Wikipedia

How To Calculate Bond Total Return 3 Ways To Assess The Total Return

Calculating The Yield Of A Coupon Bond Using Excel Youtube

What Is Yield Robinhood

Free Bond Valuation Yield To Maturity Spreadsheet

Bond Formula How To Calculate A Bond Examples With Excel Template

Valuing Bonds Boundless Finance

21 Cfa Level I Exam Learning Outcome Statements

Bond Equivalent Yield Example 2 Youtube

Bond Yields Everything You Need To Know

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

/dotdash_Final_How_Are_Bond_Yields_Affected_by_Monetary_Policy_Nov_2020-01-9f04bd0397654170a7975ba70dc403a9.jpg)

How Are Bond Yields Affected By Monetary Policy

/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

Yield To Worst Ytw Definition

Answered A Bond For The Chelle Corporation Has Bartleby

Bond Equivalent Yield Formula Calculator Excel Template

Bond Valuation Pricing And Calculator Finpricing

Quant Bonds Yield

How To Calculate Bond Prices And Yields On The Series 7 Exam Dummies

Zero Coupon Bond Yield Calculator Ytm Of A Discount Bond

How To Calculate Yield To Maturity In Excel With Template Exceldemy

How To Calculate Yield To Worst The Motley Fool

Bond Valuation And Bond Yields P4 Advanced Financial Management Acca Qualification Students Acca Global

Pricing Bonds With Different Cash Flows And Compounding Frequencies Fidelity

Yield To Maturity Formula Ppt Download

Berk Chapter 8 Valuing Bonds

Yield To Call Ytc Calculator

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

Current Yield Of A Bond Formula Calculate Current Yield With Examples

Bond Valuation And Bond Yields P4 Advanced Financial Management Acca Qualification Students Acca Global

Yield To Call Definition Formula How To Calculate Yield To Call Ytc

Yield Curve How Yield Curve Changes Affect Annuities

Chapter 10 Bond Prices And Yields 4 19 Ppt Download

Yield To Maturity Ytm Overview Formula And Importance

Nominal Yield Meaning Formula Example Drivers Spread More Efm

Bond Yields Nominal And Current Yield Yield To Maturity Ytm With Formulas And Examples

/GettyImages-156727868-5756eb515f9b5892e8d75a58.jpg)

Callable Bonds Yield To Call And Yield To Worst

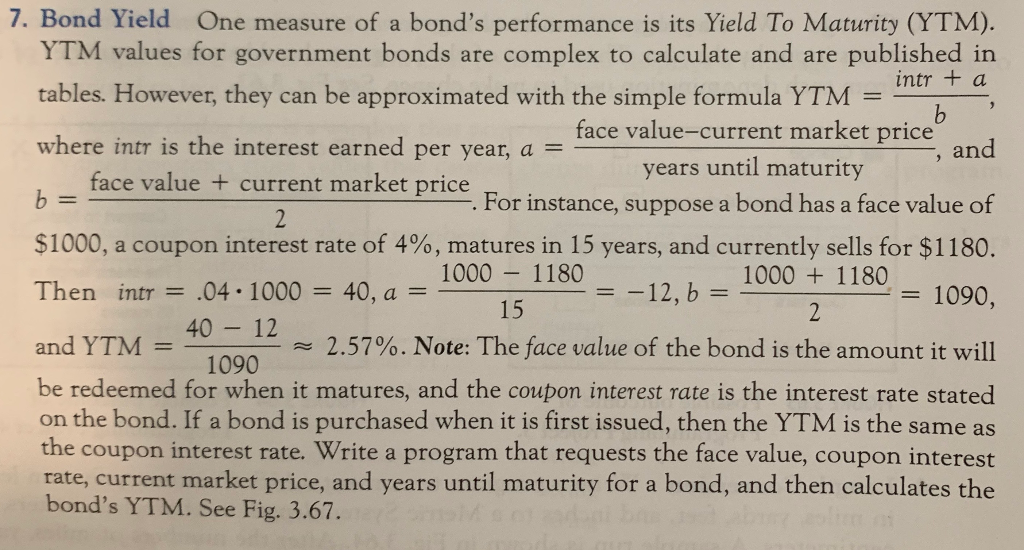

I Have To Write A Bond Yield Formula In Visual Bas Chegg Com

How To Calculate Yield For A Callable Bond The Motley Fool

Yield To Maturity Formula Step By Step Calculation With Examples

How To Calculate Yield To Maturity Definition Equation Example Financial Accounting Class Video Study Com

How To Calculate Yield For A Callable Bond The Motley Fool

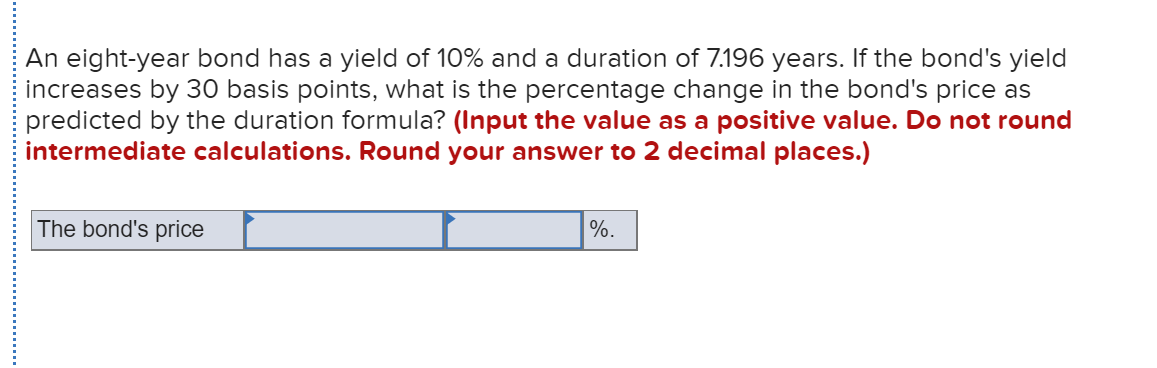

Solved An Eight Year Bond Has A Yield Of 10 And A Durati Chegg Com

What Is A Zero Coupon Bond

Vba To Calculate Yield To Maturity Of A Bond

Bond Yield To Maturity Ytm Calculator

Cost Of Debt Definition Formula Calculation Example

Q Tbn And9gctpp Yhakt6zldckkc4thylaemc1itl Zuuhu5g Pgc4 Aobhyf Usqp Cau

Quick Guide On Bond Prices And Formula Bond Calculator Pricing Market Consensus

Bonds Yield To Worst Current Yield Vs Yield To Maturity

Bond Equivalent Yield Formula With Calculator

Bond Basics Bond Yields Flashcards Quizlet

21 Cfa Level I Exam Cfa Study Preparation

Bond Yield And Return Finra Org

Berk Chapter 8 Valuing Bonds

Stata Codes For Calculating Yield To Maturity For Coupon Bonds Stataprofessor

3

/dotdash_Final_Current_Yield_Oct_2020-01-7b25f37332ff434f9bc3794782fe38fe.jpg)

Current Yield Calculator

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_Oct_2020-01-7b25f37332ff434f9bc3794782fe38fe.jpg)

Current Yield

Yield To Maturity Fixed Income

Calculating The Yield To Maturity Ytm Of A Bond Financial Management

Zero Coupon Bond Yield Formula With Calculator

Bond Yield Calculator

Ppt Yield To Maturity Formula Powerpoint Presentation Free Download Id

Bond Yield Formula Calculator Example With Excel Template

How To Calculate Yield To Maturity Definition Equation Example Financial Accounting Class Video Study Com

Muni Bonds Can Help Cushion The Bite Of Taxes Nysearca Mub Seeking Alpha

Bond Valuation Overview With Formulas And Examples

How To Calculate Ytm And Effective Annual Yield From Bond Cash Flows In Excel Microsoft Office Wonderhowto

Bond Price Calculator Present Value Of Future Cashflows Dqydj

Current Yield Calculation Formula Examples Calculator Youtube

What Is Realized Yield Fincash

Yield To Maturity Approximate Formula With Calculator

コメント

コメントを投稿